Table of Content

Our representative will call you in 24 hours and explain the documentation you will need to submit to support your application. Eligible applicants with the right credit, income, and financial profile can avail of a sizeable Top-up Loan that comes free of any end-use restrictions. Login details for this free course will be emailed to you. Master excel formulas, graphs, shortcuts with 3+hrs of Video. PV is nothing but the loan amount Mr. A is taking from the bank.

The best part about EMI is that you get to repay back the loan in small parts which are easier for most salaried individuals. If something is unaffordable for you as of now, you can purchase it by taking a loan and repaying back in smaller EMIs over a period of time. Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years.

Loan Products

Other common domestic loan periods include 10, 15 & 20 years. Some foreign countries like Canada or the United Kingdom have loans which amortize over 25, 35 or even 40 years. The total cash outflow and your revised EMI of your outstanding home loan will be calculated to assist you to make a fair comparison, in case you make a balance transfer to HDFC. This will help you to get a clear understanding of the total savings on your home loan.

Opt for a balance transfer to Tata Capital to enjoy greater flexibility of repayment tenure. The PMAY is a Government backed Credit Linked Subsidy Scheme wherein the mission is to provide affordable housing for all by the year 2022. The PMAY scheme offers its beneficiaries with subsidy, where the Pradhan Mantri Awas Yojana interest rate is charged at a subsidised or reduced rate than regular housing loans.

Trending Products

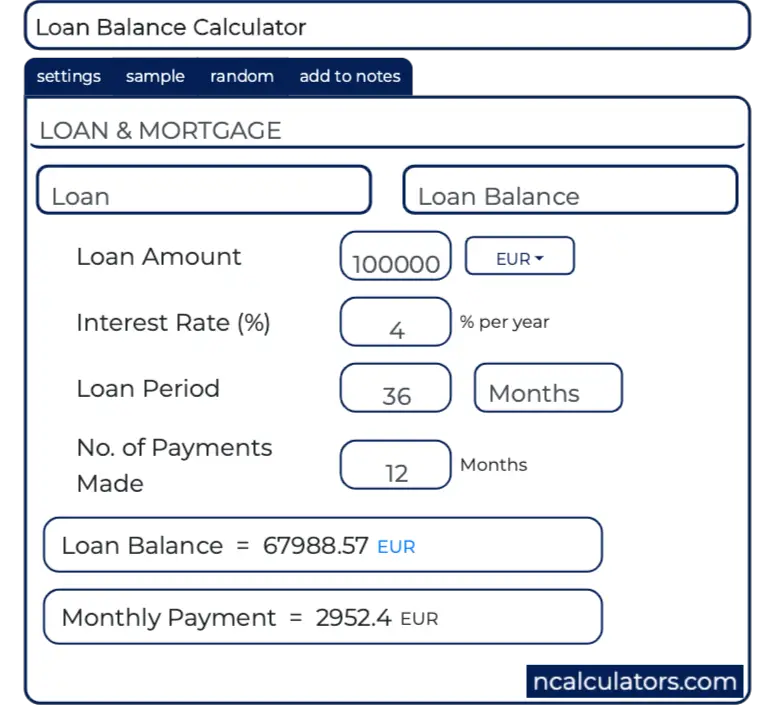

Loan calculator excel is used to calculate the monthly loan payments. Get a printable loan amortization schedule that is exportable into excel or text files. Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel.

This provides a good estimate, but the results will not match your credit card statements exactly. Home loan balance transfer occurs when the entire outstanding principal amount of a home loan is transferred from one lender to another lender. The borrower now needs to pay their EMIs on the basis of the new rate of interest, offering relatively lower interest rates. This balance transfer calculator can help you weigh your options for paying off debt by estimating how much you could save with a balance transfer, based on the information you provide. Think of this tool as a way to test the potential of an offer — depending on your payment habits and other factors — and gain a better understanding of whether a balance transfer is right for you.

Mortgage Payment Loan Calculator in Excel

Make sure to read the fine print on your credit card offer so that you understand all the conditions that affect the interest rate. Applications for new cards and loans may affect your credit score . Your score is also affected by available credit and utilization ratios. The entire process of home loan transfer takes just 15 to 20 days from the date of application. Additionally, your existing lender may take 10 to 15 days to handover the property documents to the new lender.

Since this amount is a credit given by the bank, we need to mention this amount is negative. The first thing is the rate, so the interest rate selects the B6 cell. Since the interest rate is per annum, we need to convert it to month by dividing the same by 12. Use HDFC’s Home Loan Refinance Calculator to find out the savings in EMI, resulting in lower cash outflow towards your home loan.

Can you calculate savings using a Home Loan Refinance Calculator?

Tata Capital offers Two Wheeler Loans for you to own the bike of your choice. We offer up to 100% funding on your new motorcycle or scooter. Whether you want to expand your business, or you need funds for your personal use, our Loan Against Property will cover all your financial needs. Only mortgage activity by Credit Karma Mortgage, LLC., dba Credit Karma is licensed by the State of New York.

A marriage today comes with its fair share of frills, thrills and not to mention - Bills. A Personal Loan for Wedding enables you to pay for anything related to your special day. We help you find a loan that fits your budget in a timely manner and make your fairy-tale wedding come to life. Tata Capital offers Personal Loan Overdraft facility with the flexibility to withdraw funds as per your need and pay interest only on the utilized amount. Insurance related services offered through Credit Karma Insurance Services, LLC, which does business in some states as Karma Insurance Services, LLC.

This is because a calculator can’t consider every detail of a balance transfer. Also, individuals can get an idea about the possible returns if the savings due to home loan balance transfer are invested. One an individual uses a balance transfer calculator, he/she can also get an idea of the expected EMIs payable after the balance transfer. Using a balance transfer calculator is crucial if you are willing to save on interest and to assess whether, at all, the balance transfer is worth it. Loan start date - the date which loan repayments began, typically a month to the day after the loan was originated.

This spreadsheet was designed to evaluate the benefit of using a credit card balance transfer as a way to pay off a credit card faster. The basic idea is to transfer the balance of a card to a new card that has an initial 0% interest period so that more of your initial payments can go towards paying down principal instead of interest. Other loans taken which are not housing loans will also count as monthly obligations. Repayment of a housing loan’s EMI will also become a monthly obligation once it is sanctioned. Fixed obligations are a popular parameter used by Tata Capital to calculate a borrower’s home loan eligibility.

For the existing EMI, you need to consider the loan amount and the loan tenure and rate of interest offered by Tata Capital. The introductory purchase APR on credit cards always expire at some point. Some cards include a penalty APR that goes into effect if you’re late with a payment. If that’s the case, you’ll face a high purchase APR and might see your intro balance transfer APR period cut short.

There are more factors to consider than just the math, but the following calculator can at least help with the math. It compares paying off the original card vs. the balance transfer and estimates the amount saved. Once you’ve plugged different balance transfer offers into the calculator, there’s still some more research ahead of you that can help you successfully pay down your debt with a balance transfer.

How to repay your Home Loan quicker

You can see the bulk of the EMI payments during the initial years goes towards interest payment. If you have a home loan, just ask your lender for the home loan amortization table. It will indicate exactly your outstanding home loan amount at any point in time. Or you can easily get a quick idea of the same using online loan amortization table calculators. Optional extra payment - if you want to add an extra amount to each monthly payment then add that amount here & your loan will amortize quicker. If you add an extra payment the calculator will show how many payments you saved off the original loan term and how many years that saved.

A balance transfer is one of the techniques you can consider using to lower the interest rates on your debts. You can also try contacting creditors directly to negotiate lower rates on existing cards. If you have multiple debts, you can use these techniques along with a debt snowball calculator.

No comments:

Post a Comment